2014 Homebuyer Survey Contains Valuable Information

Well another year has come and gone. As we near the end of 2014, it is a good idea to reflect on the progress we have made in our own lives over the past year. Hopefully, some of you achieved the goals you set for yourselves at the beginning of 2014. And as we look ahead to the new year, it is time to set new goals for ourselves based on our progress this year.

The 2014 real estate market has seen declines and increases with regard to past years, has continued some trends and is changing with the times. As the internet becomes easier to access with mobile devices, it is safe to say the internet is leading the way in the home buying search process. Read the following article from RealtyTimes to find out the results of the 2014 home buyer and seller survey.

One of the most useful research projects of the National Association of REALTORS®(NAR) is the annual survey of homebuyers and sellers. It is particularly useful because it shows sellers and their agents what works and what sources buyers use to find their new homes.

The most recent version (2014 Profile of Home Buyers and Sellers) became available in November of this year. The information is based on answers to a 127-question survey mailed to a random sample of 72,206 consumers who purchased a home between July 2013 and June 2014. (Names and addresses were provided by Experian, a company that maintains an extensive database of recent homebuyers that is derived from county records.) After accounting for undeliverable surveys, there was a 9.4 percent response rate.

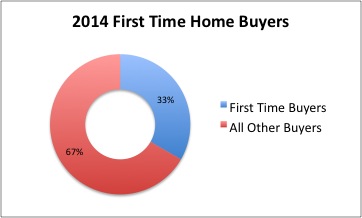

In 2014, first-time homebuyers constituted 33 percent of the market. This reflects a steady drop since 2010, and in fact is the lowest figure in more than a decade. Even with interest rates at record lows, the first-time buyer market is still quite weak. The tightening of lending standards is no doubt a major factor. Moreover, the widespread prevalence of student loan debt, combined with an economy that still remains uncertain for many in this cohort, has taken a toll.

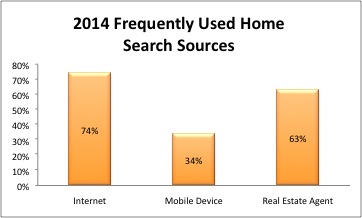

The most useful information for sellers and their agents is to be found in the section on the home search process. While the survey results are not significantly different from those of recent years, the trends continue. For example, this year 74 percent of buyers said that they used the internet frequently during the search process. In 2003 that number was only 42%. This past year 34% of buyers said that they frequently used a mobile or tablet application. That is a newer and growing phenomenon. 63% of buyers said that they frequently relied on a real estate agent for information.

The most useful information for sellers and their agents is to be found in the section on the home search process. While the survey results are not significantly different from those of recent years, the trends continue. For example, this year 74 percent of buyers said that they used the internet frequently during the search process. In 2003 that number was only 42%. This past year 34% of buyers said that they frequently used a mobile or tablet application. That is a newer and growing phenomenon. 63% of buyers said that they frequently relied on a real estate agent for information.

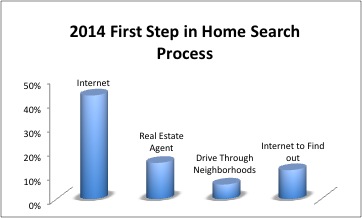

Forty-three percent of buyers went to the internet as the first step in the home search process. 15% contacted a real estate agent first, and 6% began by driving through neighborhoods looking for homes for sale. 12% first went online to find out about the process.

Forty-three percent of buyers went to the internet as the first step in the home search process. 15% contacted a real estate agent first, and 6% began by driving through neighborhoods looking for homes for sale. 12% first went online to find out about the process.

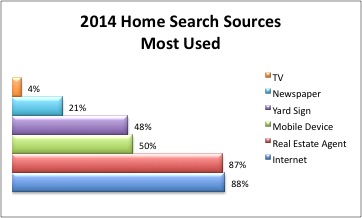

Buyers use multiple sources of information in the process of looking for a home. Far and away the most used sources are on-line websites (88%) and real estate agents (87%). Mobile or tablet applications (50%) have replaced yard signs as the third most used source of information. Still though, 48% of buyers indicate that yard signs are one of their sources of information. Only 21% of buyers indicate that they used newspaper ads as an information source. A mere 4% garnered information from television.

Buyers use multiple sources of information in the process of looking for a home. Far and away the most used sources are on-line websites (88%) and real estate agents (87%). Mobile or tablet applications (50%) have replaced yard signs as the third most used source of information. Still though, 48% of buyers indicate that yard signs are one of their sources of information. Only 21% of buyers indicate that they used newspaper ads as an information source. A mere 4% garnered information from television.

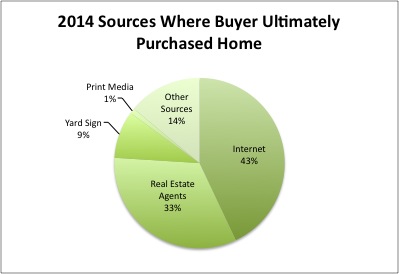

While there are a lot of intriguing data about the sources of information used by prospective homebuyers, certainly the most relevant has to do with where they actually found the home that they ultimately purchased. This year the information source that was highest in that category (43%) was the internet. Agents are second at 33%. Note that this is not to say that buyers bought their home through the internet. The typical scenario would be that a consumer sees the home on the internet, and then contacts his or her agent. 90% of those who used the internet to search purchased their home through an agent.

The differences in a little more than a decade are fascinating. In 2001, 48 percent of buyers learned about their home through a real estate agent, and only 8 percent found their home on the internet. The times they have changed.

Some things, though, remain persistently the same -- or close to it. In 2001, a yard sign was the third most likely source of information leading to the home that was purchased (15%). And this year? It is still the third leading source at 9%, but this is now the second time in the survey history that it has been lower than double digits. Print media may not be dead, but it has shrunk to insignificance in this arena. In 2001, 7% of homebuyers found the home they ultimately purchased through a newspaper ad; in 2014, it was only 1%. Fewer than 1% found their home through a home book or magazine.

Hope you all have a very Happy New Year!

Article originally posted on RealtyTimes

These days, universal design features are an everyday fact of life for many households, with architects and other professional designers adding universal design ideas as a matter of course.

These days, universal design features are an everyday fact of life for many households, with architects and other professional designers adding universal design ideas as a matter of course.