Good Afternoon!

There may never be a more opportune time to purchase a home than right now for a variety of reasons. The following is an article from "Realty Times" that explains why!

There may never be a more opportune time to purchase a home than right now for a variety of reasons. The following is an article from "Realty Times" that explains why!

"If you don't buy a home right now, you are STUPID!"

That's what Bloomberg said back in 2009. Actually, they said, "If You Don't Buy a House Now, You're Stupid or Broke."

They continued, "Well, you may not be stupid or broke. Maybe you already have a house and you don't want to move. Or maybe you're a Trappist monk and have forsworn all earthly possessions. Or whatever. But if you want to buy a house, now is the time, and if you don't act soon, you will regret it. Here's why: historically low interest rates."

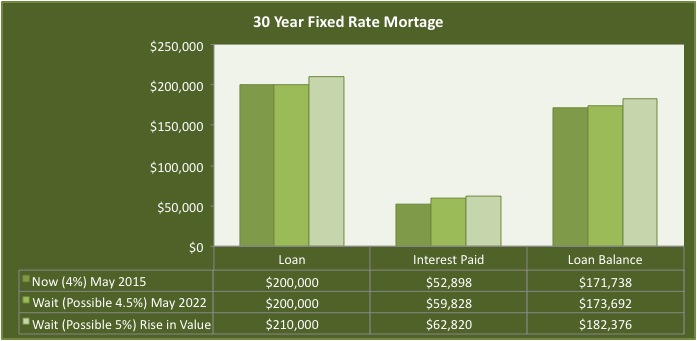

They were talking about rates hovering around five percent. Today, rates are under four percent for a 30-year fixed-rate loan.

Reason No. 1 to buy now: Rates are low

"Low mortgage rates continue to keep ownership less expensive than renting," said Investopedia. "Even a small change in interest rates has a significant effect on what you'll pay each month and over the life of a 30-year mortgage. Take a $172,000 30-year mortgage, for example ($172,000 is 80% of the median sales price for existing homes of $215,000 after a 20% down payment). With an interest rate of 4%, you would pay $821.15 each month. At an interest rate of 5%, the monthly payment would be $923.33, and at 6%, the payment rises to $1031.23."

Reason No. 2: Rents are high

In many markets, rents are rising to unsustainable levels, reports the National Association of Realtors (NAR). "In the past five years, a typical rent rose 15% while the income of renters grew by only 11%."

The cities with the highest rent increase since 2009 include New York, San Jose, San Francisco, Denver, and Seattle. For the rest of the list, click here, and to see how much more renting can cost you over a lifetime, check out Riskology.

Reason No. 3: Qualifications are easier

During the real estate downturn of the mid-2000s, banks and lenders tightened the reins, and often only the most qualified applicants could get approved. Post-recession, qualifications have loosened. Buyers who can't show solid income and a minimum credit score probably won't be offered a risky interest-only ARM today, however, those with less-than-perfect credit and minimal funds still have options. The Federal Housing Association (FHA) minimums are a 620 credit score and a 3.5 percent down payment.

Reason No. 4: Private mortgage insurance fees are down

Buyers who put less than 20 percent down on their home generally incur a monthly fee in the name of private mortgage insurance (PMI). In January 2015, the government announced lower PMI rates on Federal Housing Administration (FHA) loans, which equates to a savings of about $900 a year. Seventy-five dollars a month may not seem like much, but every little bit helps when you're committing to an investment as large as a home.

Reason No. 5: It's still one of the best investments out there

In fact, some would say it's the very best investment out there.

"Buying a home is the best investment any individual can make. Affordability is still at an all-time high," said CNBC.

Not only as a comparison between buying and renting, but as a measurable asset, homeownership stands up—as long as buyers make a smart decision.

"The largest measurable financial benefit to homeownership is price appreciation," said Investopedia. "Price appreciation helps build home equity, which is the difference between the market price of the house and the remaining mortgage payments."

Reason No. 6: It feels good

You know that pride of ownership thing? It's true. Really. Nothing compares to the feeling of walking into a home that's yours for the first time. Or painting the walls a color other than white. Updating the kitchen. Making it your own. Not worrying about your rent being raised. And, of course, watching your equity grow over time.

Have An Awesome Week!

THIS WEEKS HOT HOME LISTING!

3985 Monroe St

3985 Monroe St

Price: $450,000 Beds: 4 Baths: 3 ½ Baths: 1 Sq Ft: 3142

Picturesque property in the hills! This 0.45 acre property backs up to a creek offering expansive views of the trees and sounds of nature. Entertain easily on 2 decks in the fenced backyard and in large bonus room on lower level. This home has an op...

View this property >>

AND HERE'S YOUR MONDAY MORNING COFFEE!!

185 Crest Drive

185 Crest Drive

3097 Summit Sky Blvd

3097 Summit Sky Blvd You've probably heard how important curb appeal is when you're trying to sell your home. The first thing buyers look at when they pull up to your home is the big picture -- the house, the yard, the trees, the flowers. It's the impression that counts, and all it takes is one thing to ruin the effect -- a cracked walkway, dead branches in the trees, leggy bushes.

You've probably heard how important curb appeal is when you're trying to sell your home. The first thing buyers look at when they pull up to your home is the big picture -- the house, the yard, the trees, the flowers. It's the impression that counts, and all it takes is one thing to ruin the effect -- a cracked walkway, dead branches in the trees, leggy bushes. 88428 Partridge Ln

88428 Partridge Ln

There may never be a more opportune time to purchase a home than right now for a variety of reasons. The following is an article from "Realty Times" that explains why!

There may never be a more opportune time to purchase a home than right now for a variety of reasons. The following is an article from "Realty Times" that explains why! 3985 Monroe St

3985 Monroe St 6076 Fernhill Loop

6076 Fernhill Loop First-Time Home-Buyers: Know What You Can Afford

First-Time Home-Buyers: Know What You Can Afford 4220 Heins Court

4220 Heins Court