Good Morning!

Last week, I wrote about the challenges with "flipper" properties. This week I am expanding on that with this informative article about "flipping" homes from Realty Times.

Turn on HGTV or any number of other channels almost anytime during the day or night and you're bound to find at least a couple of shows about flipping houses. Some provide a cautionary tale about overextending yourself financially or making other rookie flipping mistakes, but the vast majority end up with a profit of $30,000, $60,000, or $100,000+ in profit for a couple of months (or a couple of days, in the case of one new flipping show).

Enticing, right? If you're getting ready to plunk down cash to flip a house here in the Eugene real estate market, here are a few things you need to think about.

Enticing, right? If you're getting ready to plunk down cash to flip a house here in the Eugene real estate market, here are a few things you need to think about.

1. Make sure you've got the money

Sounds obvious, but…do you really know the financial stakes involved? According to Investopedia, "The first expense is the property acquisition cost. While low/no money down financing claims abound, finding these deals from a legitimate vendor is easier said than done. Also, if you're financing the acquisition, that means you're paying interest." Investopedia continues, "Every dollar spent on interest adds to the amount you will need to earn on the sale just to break even."

If you're planning to pay cash, you won't have to worry about interest, but you will have carrying costs including utilities, property taxes, and HOA fees where applicable.

Here are a few other options for buying property to flip, courtesy of Auction.com: "If you don't have enough cash to purchase a home, the next cheapest source is a home equity line of Credit (HELOC). These are low-interest, variable-rate lines of credit that are secured by either your primary residence or an investment property. Typically, the HELOC rate is set about 1–2% above the prime rate. You need to put the HELOC in place before you bid on any homes; then you can bid on the home as a ‘cash deal,' rather than as a ‘financing deal.' Many investors use hard money loans or other conventional mortgages to finance their flips. Because of the higher interest rates and points paid at closing, both will reduce your net profit considerably, and are not recommended for flips unless absolutely necessary." Well said.

2. Buy in the best location you can

"Expert house flippers can't stress this enough," said MoneyCrashers. "Find a home in a desirable neighborhood, or in a city where people want to live." And keep in mind the convenience factor—for the potential buyers, certainly, but also for you. "You will work on this house daily in the weeks and months to come. Do you really want to work all day, and then drive an hour to get home? Don't invest in a house too far away from where you live; you will spend more money on gas, and it will take longer to fix up the house."

3. Work with a realtor...or become one

Tying to maximize profit by selling a flip yourself rarely works out well if you don't know what you're doing. If you think trying to figure out if the wall you want to take down is load bearing is complicated, just try to figure out disclosures and conditions without going to real estate school. The money you spend on a Realtor commission can be well worth it for the ability to concentrate on other things and know the sale is in good hands.

Beyond getting the home sold, good real estate agents can be helpful in other important ways when it comes to flipping. "They can help you find great deals, get you comps, help you connect with lenders or contractors, and a lot more," said BiggerPockets. "Don't settle for an average agent though—find a great investor friendly agent."

4. Check the comps. And check them again...

In Oregon, of course, home sales are public record so coming up with a list of comparable properties (comps) sounds easy. The sold price of homes is readily available. But you need to be very certain that your comparables are really comparable to each other. There are lots of factors to consider, beyond even square footage, outside appearance, and number of bedrooms. Speaking of comps…you can't make a smart decision on buying, fixing up, and flipping a house if you aren't aware of the prices in the neighborhood. And that might be easier said than done. In states like Texas, Montana, and Idaho (and 5 other states), home sales are not reported and are not public record like they are in states like California. In short, do your research so you know what you're up against.

5. Make smart updates

Knowing where to spend your money is key to a successful flip. You don't want to leave key areas untouched but you also don't want to over-improve for the neighborhood. "Home improvements that increase the value of a home might include upgrading kitchen appliances, repainting the home's exteriors, installing additional closet storage space, upgrading the deck, and adding green energy technologies," said MoneyCrashers. "On the other hand, avoid home improvements that won't increase the selling price, like installing a pool, installing a whirlpool bath, or adding a sunroom to the house."

This is another good reason to use a Realtor who is a local expert: they'll be knowledgeable about specific updates that are important in the Eugene-Springfield Oregon real estate market.

6. Use good products

Scrimping on construction costs may seem like a good idea if it means your financial commitment is lower, but low-end materials might not get the home sold or fetch the sales price you want.

7. Work with good people

Everyone you work with has the ability to make your flip a success or derail it. Partner with those you can trust, and don't forget to make sure they're qualified for their role. A bargain basement subcontractor that does a shoddy job on your floors can end up costing you thousands when you have to have it redone by a professional.

On the flip side, "The real money in house flipping comes from sweat equity, said Investopedia. "If you're handy with a hammer, enjoy laying carpet, can hang drywall, roof a house and install a kitchen sink, you've got the skills to flip a house. On the other hand, if you've got to pay a professional to do all of this work, the odds of making a profit on your investment will be dramatically reduced."

In the Eugene and Springfield housing market, finding "flipper" homes that will have a good potential of becoming a succesful project for you is tough. Using the right Real Estate professional to help you find a good "flipper" property is a must. If you are interested in flipping homes, contact me. I have had 26 years of experience with finding clients investment properties that give them a good return.

Have An Awesome Week!

THIS WEEKS HOT HOME LISTING!

1058 E 19th Ave

1058 E 19th Ave

Price: $472,000 Beds: 5 Baths: 3 Sq Ft: 3034

Tudor-style home in sought after University of Oregon neighborhood! Living room with wood-burning fireplace. Formal dining with built-ins adjacent to kitchen. Five bedrooms with huge master suite on main level. Plus a sunroom. Wheelchair access. Pri...

View Home for Sale >>

AND HERE'S YOUR MONDAY MORNING COFFEE!!

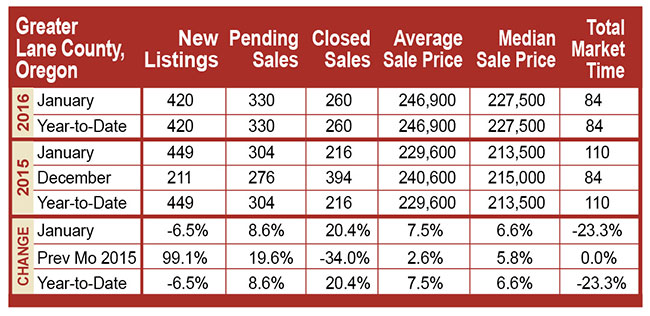

For home buyers wishing to purchase a home right now, this can be a challenge and having a top buyers agent who firmly understands the market can make all the difference in the world with regards to being successful in finding a home. Also, a word of caution to home buyers is that there are bidding wars taking place, so be cautious not to over-pay for a home. Again a professional buyers agent can help you here.

For home buyers wishing to purchase a home right now, this can be a challenge and having a top buyers agent who firmly understands the market can make all the difference in the world with regards to being successful in finding a home. Also, a word of caution to home buyers is that there are bidding wars taking place, so be cautious not to over-pay for a home. Again a professional buyers agent can help you here.

Enticing, right? If you're getting ready to plunk down cash to flip a house here in the Eugene real estate market, here are a few things you need to think about.

Enticing, right? If you're getting ready to plunk down cash to flip a house here in the Eugene real estate market, here are a few things you need to think about.  1058 E 19th Ave

1058 E 19th Ave These days, many people are really excited about finding "fixer upper" and "flipper" type properties. This has been keyed up by the many virtual reality TV shows that feature people purchasing homes in poor repair and re-conditioning them to make thousands of dollars. It all looks so easy on TV.

These days, many people are really excited about finding "fixer upper" and "flipper" type properties. This has been keyed up by the many virtual reality TV shows that feature people purchasing homes in poor repair and re-conditioning them to make thousands of dollars. It all looks so easy on TV.  28135 Spencer Creek Rd

28135 Spencer Creek Rd

2685 Valley Forge Dr

2685 Valley Forge Dr 83821 N Enterprise Rd

83821 N Enterprise Rd Many would-be homeowners are still choosing to rent instead of buying a home. Home buyer confidence remains low nationally, even though mortgage interest rates are at historic low levels. Here is an article from Realtor.com that gives some ideas as to why consumer confidence remains low among potential home buyers.

Many would-be homeowners are still choosing to rent instead of buying a home. Home buyer confidence remains low nationally, even though mortgage interest rates are at historic low levels. Here is an article from Realtor.com that gives some ideas as to why consumer confidence remains low among potential home buyers. 1014 Yew St

1014 Yew St

The Federal Reserve recently raised interest rates, U.S. stocks are tumbling and new worries about the Chinese economy seem to emerge daily. So go ahead and buy that house you’ve been looking at.

The Federal Reserve recently raised interest rates, U.S. stocks are tumbling and new worries about the Chinese economy seem to emerge daily. So go ahead and buy that house you’ve been looking at. 3759 Westleigh St

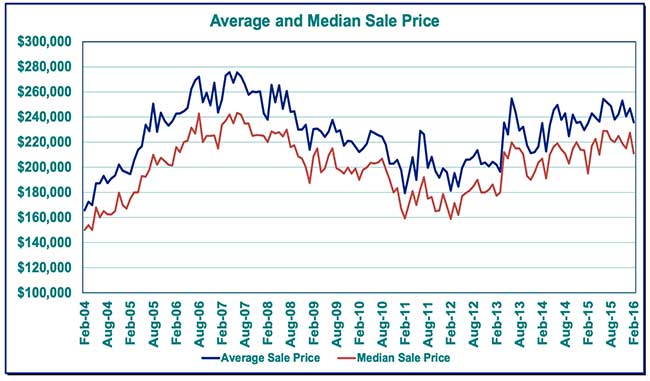

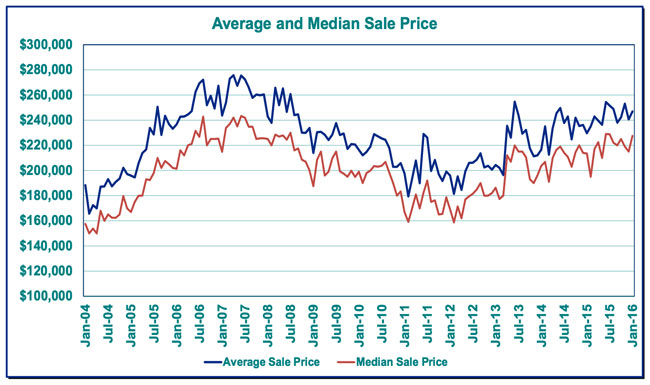

3759 Westleigh St One thing that has always been true, Eugene and Springfield Oregon have a Real Estate market that does not always follow the flow of the rest of the country. Sometimes this can be good and sometimes it might not be so good. Our local market never seems to have the abrupt ups and downs that even close market areas like Portland experience. This can be discouraging when we see other markets values jumping well above our local values, but when the market turns and those markets that had the steep gains begin the cycle down, Eugene typically does not decline as rapidly. This is good!

One thing that has always been true, Eugene and Springfield Oregon have a Real Estate market that does not always follow the flow of the rest of the country. Sometimes this can be good and sometimes it might not be so good. Our local market never seems to have the abrupt ups and downs that even close market areas like Portland experience. This can be discouraging when we see other markets values jumping well above our local values, but when the market turns and those markets that had the steep gains begin the cycle down, Eugene typically does not decline as rapidly. This is good! 2231 Sandy Drive

2231 Sandy Drive