How to Have a Fun and Safe Halloween

Good Monday Morning!

It's hard to believe, but we are at the last day of October and that means it is Halloween time. I found the following article in "Realty Times", that gives some great ideas on how to have a fun, yet safe Halloween.

It's just a few days until Halloween, and you're probably rushing to find the last Pokemon, Size Small in the state and find "the good" candy instead of the jawbreakers and Tootsie Rolls that seem to be the only thing left at Target. But while you fill your mind with costumes and sweets, don't forget to brush up on your Halloween safety. Here are 11 tips you'll want to follow.

1. Let them glow

Glow sticks, necklaces, bracelets, and the like can help make it easier to see your kids on a dark street. You can find a number of different varieties at the Dollar Store. Glow in the Dark duct tape is another cool idea that could help with visibility. For an easy solution, have a roll (or two!) of Glow-in-the-Dark Duct Tape on hand for the big night," said Red Tricycle. "You can tape up everyone's buckets, shoes and costumes for a unique look that's easy to see from afar, and it even works on those wagons you'll be using to tote the tiny trick-or-treaters from house to house."

The dark streets and sidewalks can make it hard to see your kids, let alone tell them apart from all the others. Head to the Dollar Store, where you can buy glow necklaces, bracelets, crowns, and various other varieties of light-up items that will help you keep track of them.

2. Discourage running

When kids get hurt on Halloween, it's often because they tripped or fell. No big surprise there, what with all the running in the dark. The best way we've found to curtail it: Threaten to take away their candy. Seriously, it works.

3. Make safe costume choices

Back to the running…accidents also happen because the child's costume is ill-fitting. Step on too-long pants and they could take a tumble down the porch stairs or off the curb into the street. The pants length can be adjusted without having to take them to a tailor (because who has time for that?!). Tuck them into socks or boots, use some masking or duct tape on the inside, or use Stitch Witchery, a fusable tape that allows you to create a hem by bonding it to the fabric with an iron. Make sure all costumes marked "flame retardant," which is extra important on Halloween since they may be coming into contact with open flames in pumpkins. Well-fitting arms that are not too long are important for the same reason.

When it comes to masks, use your best judgement. If your child's vision is impaired, that could contribute to an injury or other unsafe situation. Masks can also compromise breathing, and may not be suitable for children with asthma.

A new wrinkle this year is anything clown-related. If you've waited until the last minute and all that's left in the store is a red nose and a rainbow wig, trust us: Let it go.

4. Stop the props

The bonus to keeping props at home: You don't have to carry them three minutes after you leave the house.

Many of today's costumes come with accessories - a foam sword here, a princess wand there, and, this year, more Poke balls than you can imagine. Chances are, your kid will carry this prop for about three minutes—just enough for it to become a burden. Then it's yours to deal with. If you already anticipate having to help carry your children's heavy candy bags and pumpkins (and you will), encouraging them to keep the props at home is a good idea.

5. Pick a good candy-carrying bag

There's research that says ongoing use of a heavy backpack could injure a child's back. Will a few hours (or less) carrying a heavy pumpkin or bag filled with pounds of candy do the same? Probably not, but it could make for an unpleasant experience - for all of you. And, it could make the child unsteady and more prone to fall down. Look for a bag with a padded handle that won't dig into their hands or something that has a cross-body strap to better distribute the weight.

6. Don't forget about dinner

Halloween falls on a Monday this year, and that could make rushing home to get dinner together a challenge. This is the perfect time to get out that slow cooker. And make one of these Halloween slow-cooker recipes. Don't want to cook at all? Put in a pizza delivery order early in the day so you're in the system and don't get caught up in a long-wait situation with everyone who called at the last minute.

Full bellies will help your kids to keep their energy up - and their whining down.

7. Make sure you can find them

If you don't already have a locator app on your phone, now's the time to add one. If you're in a crowded area with lots of kids around, you want to make sure you can always find them.

"For a little peace of mind (and a few bucks), there are some apps you can download prior to Halloween, so you can keep tabs on everyone in your trick-or-treating crew," said Red Tricycle. "Picniic, a family management dashboard, allows you to track your kid's locations and helps the entire family stay in constant communication by checking in once arriving at a destination. With FamilySignal, this app not only tracks the location of your kids, but it also includes a panic button that will alert you as soon as your child has pushed it. If you know exactly where you're headed on Halloween, the Life360 app allows you to create favorite spots and anytime your child arrives at that location you'll get an automatic notification."

8. Watch the weather

It never fails. Your kids pick out their favorite Halloween gear and then the night before Halloween, a cold front comes through, forcing them to wear a coat over their costumes. If it's going to be frigid while they're out trick-or-treating, some long underwear underneath their costume and a hat might be enough to keep them toasty.

You'll also want to pay attention to weather conditions that could impact their footwear choices. If it's been raining, snowing, or the ground is slick, non-slip shoes will be a necessity.

9. Check their candy

Nobody wants to think about poison or other hazards in their kids Halloween candy, and documented events of poisoning or other tampering with candy are few. But, a few tips to help you know what to look for can help you feel secure. The main takeaways: if it's open, it goes in the trash. Unless you know the people giving out homemade treats and know specifically what's in them, it goes in the trash. Anything else that looks or smells suspicious goes in the trash.

10. Sort through and give away your candy

If you're anything like us, your Halloween haul is going to be impressive. And you probably won't want to keep all that candy in the house. There is a growing number of Halloween candy buyback programs that will pay you per pound of candy turned in, with some donated to families and others sent to the troops overseas.

11. Watch for allergens

While you're sorting through that candy (and, inevitably, putting aside your favorites), beware of allergens. If your child is allergic to peanuts or something else that can be dangerous, you're obviously aware of this. But do you know about teal pumpkins? Looking out for them could help your child get more enjoyment out of the holiday.

"Back in 2012, a Tennessee mom named Becky Basalone had an idea: What if Halloween could be made a little less tricky for kids with food allergies?," said the Chicago Sun-Times.

"Her idea became what is now the Teal Pumpkin Project, a nationwide effort to encourage families - whether their own kids have food restrictions or not - to offer up some non-food treats on Oct. 31. Participation is simple: You just put a teal-colored pumpkin or sign outside your door and offer trick-or-treaters glow sticks, spider rings, Halloween stickers or other non-food goodies, along with or instead of the traditional candies."

Have An Awesome Week!

THIS WEEKS HOT HOME LISTING!

Price: $529,900 Beds: 5 Baths: 3 Sq Ft: 3756

Luxurious and grand! Great room with surround sound speakers, Brazilian cherry hardwood floor & gas fireplace. Huge theater/bonus room prewired for surround sound. Open kitchen with cherry stained cabinets, island, LED under & above cabinets & toe k...View Home for Sale>>

2087 Lemuria St

2087 Lemuria St

Sales of new homes have lagged over the recent upswing in home sales not only locally, but nationally. In the Eugene and Springfield area the problem is simply that we are out of affordable land for home sites. The local government has put a halt on expansion of the urban growth boundary and the amount of land that is available for building has all but gone away. This has not only driven up building lot prices, but it has made it difficult for home builders to find lots suitable for buidling new homes. Also the recession has not been forgotten by many builders and they are wary of building spec homes. This also has created a decrease in the numbers of news home being built and on the market. Here is an article from Realtor.com that addresses this situation nationally.

Sales of new homes have lagged over the recent upswing in home sales not only locally, but nationally. In the Eugene and Springfield area the problem is simply that we are out of affordable land for home sites. The local government has put a halt on expansion of the urban growth boundary and the amount of land that is available for building has all but gone away. This has not only driven up building lot prices, but it has made it difficult for home builders to find lots suitable for buidling new homes. Also the recession has not been forgotten by many builders and they are wary of building spec homes. This also has created a decrease in the numbers of news home being built and on the market. Here is an article from Realtor.com that addresses this situation nationally. It is not common knowledge, but homeownership in the United States is at a 51 year low. This is a frightening fact because the idea of homeownership is the foundation of the American Dream. There are many factors that have contributed to this fall off on homeownership. There is currenlty a large difference in what our two presidential candidates plan to do to stimulate the housing industry. Do your homework and vote wisely. It is a very dangerous situation if homeownership continues to falter. Here is a recent article from Realtor.com that talks about some of the conditions that are having an impact on homeownership.

It is not common knowledge, but homeownership in the United States is at a 51 year low. This is a frightening fact because the idea of homeownership is the foundation of the American Dream. There are many factors that have contributed to this fall off on homeownership. There is currenlty a large difference in what our two presidential candidates plan to do to stimulate the housing industry. Do your homework and vote wisely. It is a very dangerous situation if homeownership continues to falter. Here is a recent article from Realtor.com that talks about some of the conditions that are having an impact on homeownership. 425 W 28th Ave

425 W 28th Ave

The 2016 election season has been one of the most divisive presidential races in this country's history and unfortunately, that unrest has been something of a wet blanket on the housing market nationally. While many areas in the nation have enjoyed a boom market, the sense of unease and nervousness has convinced many Americans to wait before buying or selling a home. This is not a new scenario for our country, even in years with less chaos and uncertainty, Realtor associations nationwide have noted that consumers tend to be more cautious during an election year. The question is:

The 2016 election season has been one of the most divisive presidential races in this country's history and unfortunately, that unrest has been something of a wet blanket on the housing market nationally. While many areas in the nation have enjoyed a boom market, the sense of unease and nervousness has convinced many Americans to wait before buying or selling a home. This is not a new scenario for our country, even in years with less chaos and uncertainty, Realtor associations nationwide have noted that consumers tend to be more cautious during an election year. The question is: 3686 Yogi Way

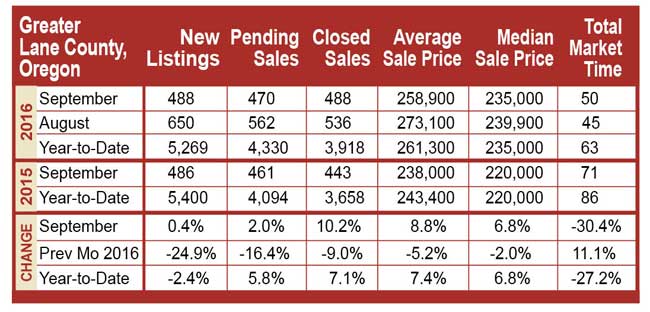

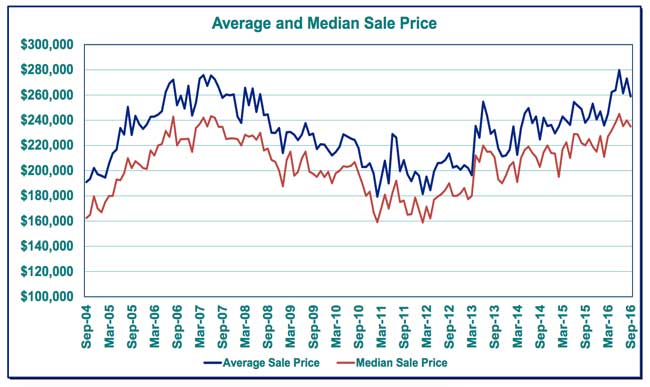

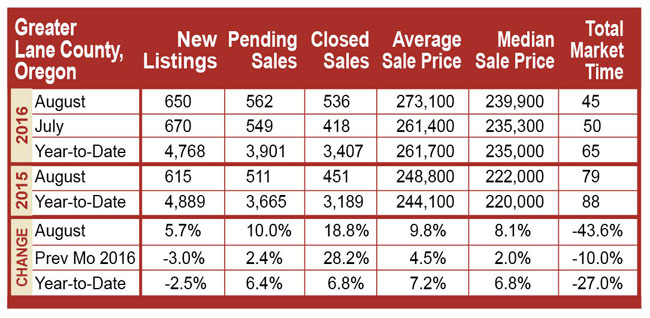

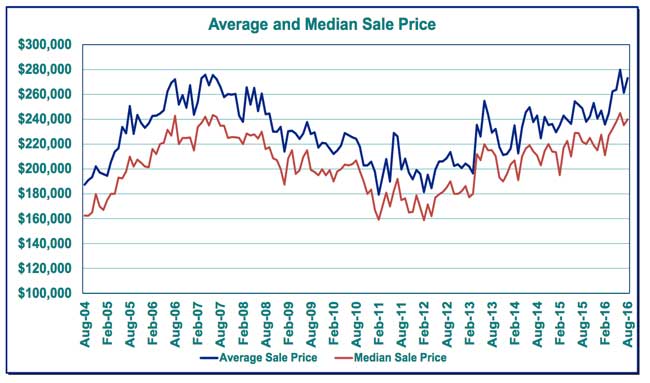

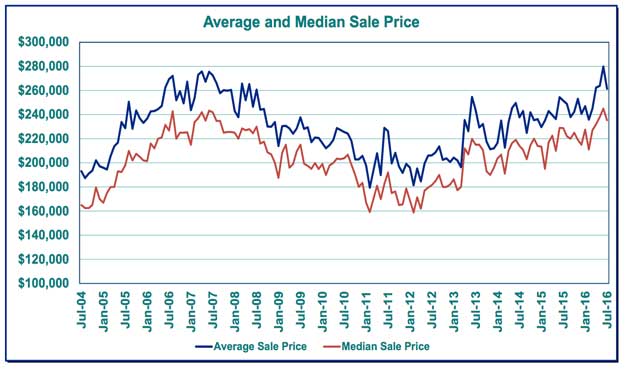

3686 Yogi Way It is not just the Eugene and Springfield area that is having a hot Real Estate market. Nationally, the housing market has been robust and just as in Eugene and Springfield, home prices are on the rise as well. Here is a short and informative article about the national housing market from Realtor.com.

It is not just the Eugene and Springfield area that is having a hot Real Estate market. Nationally, the housing market has been robust and just as in Eugene and Springfield, home prices are on the rise as well. Here is a short and informative article about the national housing market from Realtor.com.