Good Afternoon!

There may never be a more opportune time to purchase a home than right now for a variety of reasons. The following is an article from "Realty Times" that explains why!

There may never be a more opportune time to purchase a home than right now for a variety of reasons. The following is an article from "Realty Times" that explains why!

"If you don't buy a home right now, you are STUPID!"

That's what Bloomberg said back in 2009. Actually, they said, "If You Don't Buy a House Now, You're Stupid or Broke."

They continued, "Well, you may not be stupid or broke. Maybe you already have a house and you don't want to move. Or maybe you're a Trappist monk and have forsworn all earthly possessions. Or whatever. But if you want to buy a house, now is the time, and if you don't act soon, you will regret it. Here's why: historically low interest rates."

They were talking about rates hovering around five percent. Today, rates are under four percent for a 30-year fixed-rate loan.

Reason No. 1 to buy now: Rates are low

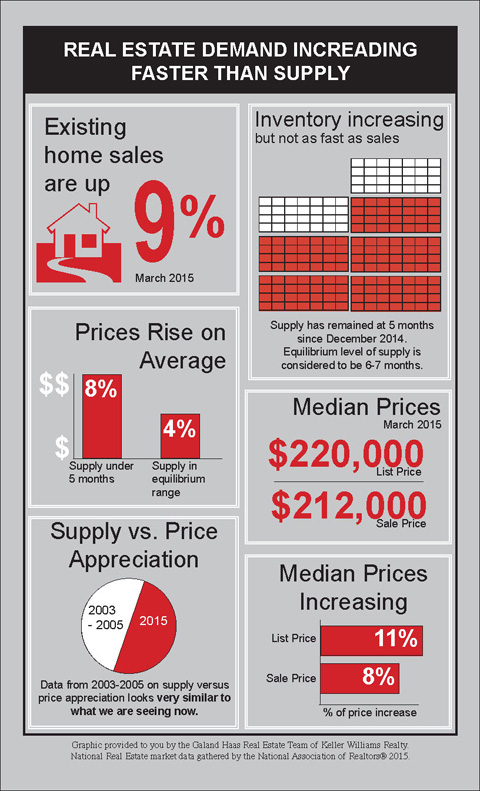

"Low mortgage rates continue to keep ownership less expensive than renting," said Investopedia. "Even a small change in interest rates has a significant effect on what you'll pay each month and over the life of a 30-year mortgage. Take a $172,000 30-year mortgage, for example ($172,000 is 80% of the median sales price for existing homes of $215,000 after a 20% down payment). With an interest rate of 4%, you would pay $821.15 each month. At an interest rate of 5%, the monthly payment would be $923.33, and at 6%, the payment rises to $1031.23."

Reason No. 2: Rents are high

In many markets, rents are rising to unsustainable levels, reports the National Association of Realtors (NAR). "In the past five years, a typical rent rose 15% while the income of renters grew by only 11%."

The cities with the highest rent increase since 2009 include New York, San Jose, San Francisco, Denver, and Seattle. For the rest of the list, click here, and to see how much more renting can cost you over a lifetime, check out Riskology.

Reason No. 3: Qualifications are easier

During the real estate downturn of the mid-2000s, banks and lenders tightened the reins, and often only the most qualified applicants could get approved. Post-recession, qualifications have loosened. Buyers who can't show solid income and a minimum credit score probably won't be offered a risky interest-only ARM today, however, those with less-than-perfect credit and minimal funds still have options. The Federal Housing Association (FHA) minimums are a 620 credit score and a 3.5 percent down payment.

Reason No. 4: Private mortgage insurance fees are down

Buyers who put less than 20 percent down on their home generally incur a monthly fee in the name of private mortgage insurance (PMI). In January 2015, the government announced lower PMI rates on Federal Housing Administration (FHA) loans, which equates to a savings of about $900 a year. Seventy-five dollars a month may not seem like much, but every little bit helps when you're committing to an investment as large as a home.

Reason No. 5: It's still one of the best investments out there

In fact, some would say it's the very best investment out there.

"Buying a home is the best investment any individual can make. Affordability is still at an all-time high," said CNBC.

Not only as a comparison between buying and renting, but as a measurable asset, homeownership stands up—as long as buyers make a smart decision.

"The largest measurable financial benefit to homeownership is price appreciation," said Investopedia. "Price appreciation helps build home equity, which is the difference between the market price of the house and the remaining mortgage payments."

Reason No. 6: It feels good

You know that pride of ownership thing? It's true. Really. Nothing compares to the feeling of walking into a home that's yours for the first time. Or painting the walls a color other than white. Updating the kitchen. Making it your own. Not worrying about your rent being raised. And, of course, watching your equity grow over time.

Have An Awesome Week!

THIS WEEKS HOT HOME LISTING!

3985 Monroe St

3985 Monroe St

Price: $450,000 Beds: 4 Baths: 3 ½ Baths: 1 Sq Ft: 3142

Picturesque property in the hills! This 0.45 acre property backs up to a creek offering expansive views of the trees and sounds of nature. Entertain easily on 2 decks in the fenced backyard and in large bonus room on lower level. This home has an op...

View this property >>

AND HERE'S YOUR MONDAY MORNING COFFEE!!

28135 Spencer Creek Rd

28135 Spencer Creek Rd

4181 N Clarey St

4181 N Clarey St 185 Crest Drive

185 Crest Drive 3097 Summit Sky Blvd

3097 Summit Sky Blvd

There may never be a more opportune time to purchase a home than right now for a variety of reasons. The following is an article from "Realty Times" that explains why!

There may never be a more opportune time to purchase a home than right now for a variety of reasons. The following is an article from "Realty Times" that explains why! 3985 Monroe St

3985 Monroe St 6076 Fernhill Loop

6076 Fernhill Loop For people who are in the process of buying a house, our best advice is to lock in your rate now. “This is the last call before the bar closes at these historically low levels,” said Jonathan Smoke, chief economist at realtor.com®.

For people who are in the process of buying a house, our best advice is to lock in your rate now. “This is the last call before the bar closes at these historically low levels,” said Jonathan Smoke, chief economist at realtor.com®. 775 N 8TH ST

775 N 8TH ST

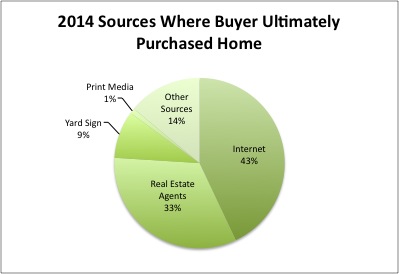

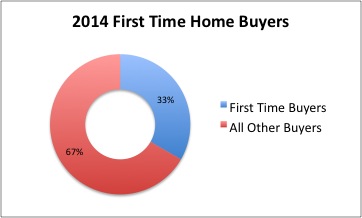

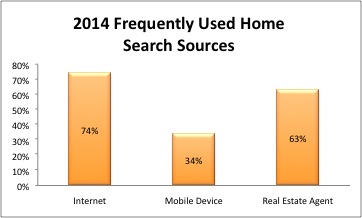

The most useful information for sellers and their agents is to be found in the section on the home search process. While the survey results are not significantly different from those of recent years, the trends continue. For example, this year 74 percent of buyers said that they used the internet frequently during the search process. In 2003 that number was only 42%. This past year 34% of buyers said that they frequently used a mobile or tablet application. That is a newer and growing phenomenon. 63% of buyers said that they frequently relied on a real estate agent for information.

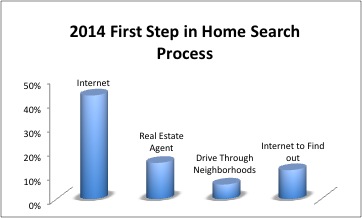

The most useful information for sellers and their agents is to be found in the section on the home search process. While the survey results are not significantly different from those of recent years, the trends continue. For example, this year 74 percent of buyers said that they used the internet frequently during the search process. In 2003 that number was only 42%. This past year 34% of buyers said that they frequently used a mobile or tablet application. That is a newer and growing phenomenon. 63% of buyers said that they frequently relied on a real estate agent for information. Forty-three percent of buyers went to the internet as the first step in the home search process. 15% contacted a real estate agent first, and 6% began by driving through neighborhoods looking for homes for sale. 12% first went online to find out about the process.

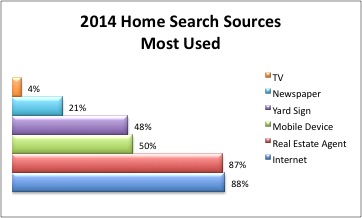

Forty-three percent of buyers went to the internet as the first step in the home search process. 15% contacted a real estate agent first, and 6% began by driving through neighborhoods looking for homes for sale. 12% first went online to find out about the process. Buyers use multiple sources of information in the process of looking for a home. Far and away the most used sources are on-line websites (88%) and real estate agents (87%). Mobile or tablet applications (50%) have replaced yard signs as the third most used source of information. Still though, 48% of buyers indicate that yard signs are one of their sources of information. Only 21% of buyers indicate that they used newspaper ads as an information source. A mere 4% garnered information from television.

Buyers use multiple sources of information in the process of looking for a home. Far and away the most used sources are on-line websites (88%) and real estate agents (87%). Mobile or tablet applications (50%) have replaced yard signs as the third most used source of information. Still though, 48% of buyers indicate that yard signs are one of their sources of information. Only 21% of buyers indicate that they used newspaper ads as an information source. A mere 4% garnered information from television.