Is This the Beginning of Another Housing Bubble?

Good Morning!

I am oftened asked if our current Real Estate market is the beginning of another housing bubble. The answer is complicated, but here is a recent article written by one of the economists for the National Association of Realtors that addresses our current national Real Estate market.

This spring buying season is off to a strong start—in fact, prices are going up faster than they were just a few months ago, according to nearly every recent metric. So does that mean we’re in a bubble?

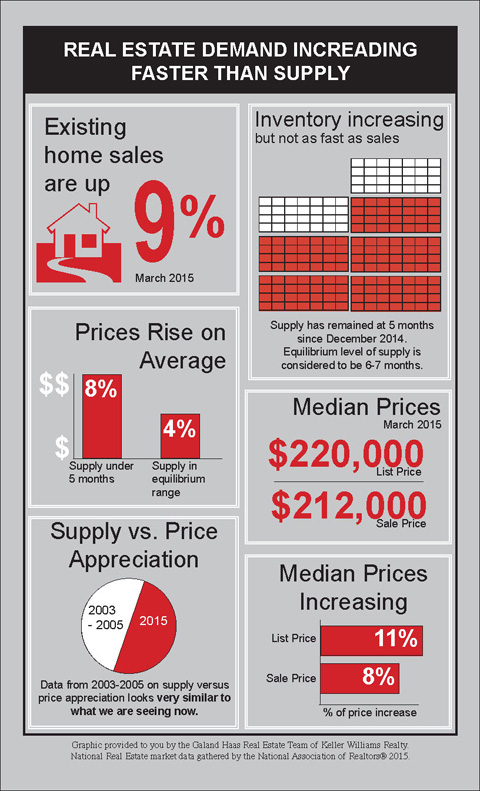

Nope, that’s just what happens when demand increases faster than supply. After all, existing-home sales were up 9% year over year in March, according to the National Association of Realtors®. Inventory is also increasing, but not as fast as sales, resulting in a tight supply getting even tighter.

Nope, that’s just what happens when demand increases faster than supply. After all, existing-home sales were up 9% year over year in March, according to the National Association of Realtors®. Inventory is also increasing, but not as fast as sales, resulting in a tight supply getting even tighter.

An equilibrium level of supply on the market is considered to be six to seven months; supply has been under five months since December. Looking at every quarter since 1988, when supply was under five months, prices rose 8% year over year on average. When supply was in the equilibrium range, prices went up only 4% on average.

The median existing home price in March was $212,100, up 8% over last year, according to the NAR. The median list price in March on realtor.com® was $220,000, which was up 11% over last year.

During the peak years of the housing bubble, from 2003 to 2005, the data on supply versus price appreciation looked very similar to what we are seeing now. But there are key differences, which is why I’m confident that on the national level, this is no bubble.

Here’s why, this time, the price increases should stick:

The level of the current price appreciation is not like the bubble. Prices went up 7% and 12% in 2012 and 2013, respectively, as the market corrected for too-severe price declines in the prior years. Last year, the appreciation level moderated. Even factoring in the one-time bounce from the prior overcorrection, median prices have grown less than 8% on a compounded annual basis over the past three years. Median prices, by comparison, grew 10% on a compounded annual basis from 2002 to 2005, without any bounce from a prior decline. On an inflation-adjusted basis, we are 30% beneath the peak set in 2005.

Likewise, relative to rents or incomes, median home prices are not “unhinged” from long-term averages. The price-to-rent ratio is similar to the rate in the mid-1990s. It was 35% higher in 2005. The price-to-income ratio is now where it was in 2001, and it was about 30% higher in 2005.

During the housing bubble, we saw both prices and sales grow to historical levels fueled by a rapid expansion in mortgage financing. We are clearly not experiencing record sales or record mortgage originations now.

As a result, we are not seeing vacancies increase like they did at the end of the bubble. In 2005, vacancies started to rise before sales and prices reached their peak as a result of flipping activity and overleveraged speculative investing. On the contrary now, vacancies have slowly trended back to more normal levels.

So, today’s higher prices are only to be expected as the economy improves and first-time buyers gradually return to the market. Eventually, those higher prices should encourage more owners to list their homes and builders to start construction on new housing—which in turn should solve the problem of supply.

Have An Awesome Week!

THIS WEEKS HOT HOME LISTING!

4181 N Clarey St

4181 N Clarey St

Price: $210,000 Beds: 3 Baths: 1 Sq Ft: 1350

Beautiful home inside and out! On almost 1/4 acre featuring privacy hedges, flower & vegetable garden, large fenced backyard, huge covered patio, RVP + hookup, 2-car garage, carport, shop with wood rick, & tool shed. Living room with fireplace opens...

View this property >>