Good Monday Morning!

There has been a large number of home accidents over the past several months in the Eugene and Springfield area. With that in mind, I am sending this article from "Realty Times" on home accidents.

There has been a large number of home accidents over the past several months in the Eugene and Springfield area. With that in mind, I am sending this article from "Realty Times" on home accidents.

It's safe to say that none of us are purposely making our homes a hazard. And, no matter how hard we try, accidents still happen. But there is nothing more important than protecting ourselves, our families, and our investment.

"The home is supposed to be where you and your family are safe and protected but every year accident and emergency units deal with serious injuries and sometimes fatal accidents that occur in the home," said StaySafe. "It is not just children and the elderly that can come to harm in the home with things like chemicals and choke hazards. Accidents in the home claim 18,000 lives each year in America alone, "accounting for 21 million medical visits annually. Many of these accidents are preventable."

These tips will uncover key areas where dangers typically lie and the simple maintenance involved in avoiding them.

Dryer vents

Thousands of fires are started in the home every year because of deferred maintenance related to the clothes dryer. You may clean out the lint screen, but it's the lint you can't see that accumulates in the vent that can be dangerous. The U.S. Fire Administration (USFA) "recommends cleaning or having a professional inspect the vent for lint build-up a minimum of every two to three years," said Hunker. "Keep a fire extinguisher nearby in case a fire does break out in or around your dryer."

Falls

A third of all fatalities in the home are due to falls. A great number of them are related to old age, however people of all ages can also be at risk. Installing safety gates at the top and bottom of stairs is an obvious safety precaution with little ones, as are grab bars in bathrooms that are serving older individuals. Closely monitoring wet areas - just outside the shower and bath and in front of the kitchen sink - can help with slips. Installing nonslip rug pads under area rugs is key to keeping them in place and eliminating falls.

Blinds

The thought of a young child being strangled due to hanging cords from window blinds is horrifying. But it happens. According to USA Today, "Injuries and death from window blind cords send two kids to emergency department each day." Eliminate the worry without having to give up the blinds by choosing a cordless version. They give you the look and room-darkening features you want with some added safety measures.

Fire alarms

When's the last time you changed your fire alarm batteries? If you can't remember, you're obviously overdue. "Install fire alarms on all levels of your home, and check and change the batteries at least annually," said safewise. "Consider investing in a smart smoke detector like Nest Protect. This alarm uses Wi-Fi to provide real-time updates and remote monitoring right on your smartphone or other mobile device."

A dirty oven

Most ovens today have a self-cleaning feature. While it's not entirely pleasant to endure the smell while it's doing its thing, it far outweighs the alternative, especially considering 40 percent of fires in the home start in the kitchen.

"A dirty oven can cause fires while cooking, allowing charred food or grease to ignite," said Home Security. "Clean your oven regularly and always attend food while cooking in the oven.'

Carbon monoxide posioning

Carbon monoxide is called the silent killer because "its presence is not known until symptoms of the exposure are experienced," said Poison Control. "It is a colorless, odorless, tasteless, and potentially dangerous gas. You can't see it or smell it."

It's typical for smoke detectors to be in homes, but despite the fact that a carbon monoxide detector can save lives, they are often left to the homeowner to purchase and install. "Each year in the United States, more than 200 accidental deaths are caused by carbon monoxide (CO) poisoning. It is considered the leading cause of death from poisoning in the United States.

Have an awesome week!

THIS WEEK'S HOT HOME LISTING!

Price: $269,900 Beds: 3 Baths: 2 Sq.Ft: 1,172

Fantastic updated home in Ferry Street Bridge! New laminate wood floors, doors and hardware, fresh interior and exterior paint, and kitchen countertop. Bright and open inside. Living room with dining area. Kitchen with eating bar opens to family roo... View this property >>

AND HERE'S YOUR MONDAY MORNING COFFEE!!

84305 DERBYSHIRE LN

84305 DERBYSHIRE LN

It seems that much of the nation is beginning to feel the pressure from housing markets that are quickly becoming over-priced. California, which has had extreme housing inflation for years is feeling the pain of an over-priced market and home sales are beginning to slow down quickly in many areas. California many times leads national housing trends. Here is an article from MSNBC that talks about the housing market changes.

It seems that much of the nation is beginning to feel the pressure from housing markets that are quickly becoming over-priced. California, which has had extreme housing inflation for years is feeling the pain of an over-priced market and home sales are beginning to slow down quickly in many areas. California many times leads national housing trends. Here is an article from MSNBC that talks about the housing market changes. BOLTON HILL RD

BOLTON HILL RD  6997 Glacier Drive

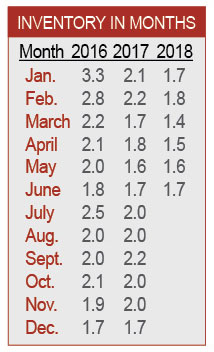

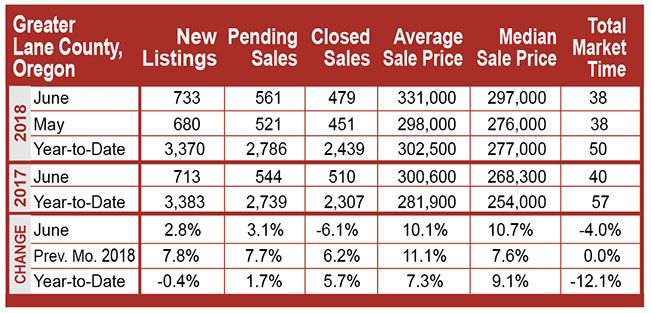

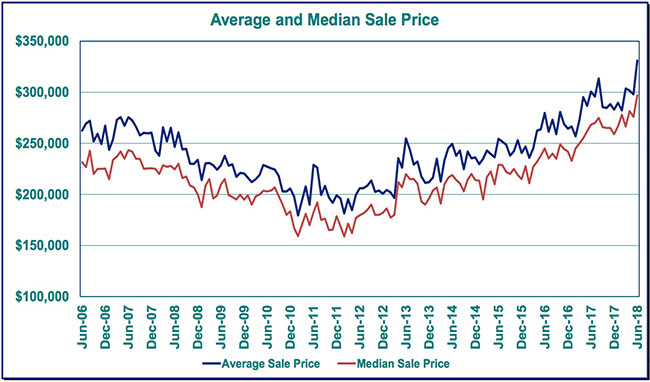

6997 Glacier Drive The numbers are in and Lane County had another strong month of home sales for June of 2018. The primary thing to note is that the average home sales price continues to increase and is now over $300,000 as you will see. One has to wonder how long this trend can continue in a market with a wage scale that does not support this high of an average home price? Here are the numbers for June of 2018.

The numbers are in and Lane County had another strong month of home sales for June of 2018. The primary thing to note is that the average home sales price continues to increase and is now over $300,000 as you will see. One has to wonder how long this trend can continue in a market with a wage scale that does not support this high of an average home price? Here are the numbers for June of 2018.

6997 Glacier Drive

6997 Glacier Drive

Even in the strong sellers market that we are currently experiencing in the Eugene and Springfield area, there are always a few homes that just don't sell. 9 times out of 10, the issue is price. We find that even during hot markets, overpriced homes may get looked at, but they just do not attract offers. Pricing with the market is crucial with any kind of market and today, we find that competitive pricing often brings in multiple offers and the purchase war begins. This strategy will bring about a sale for top dollar value in any market. Along with this, there are a few things that homeowners can do to make their home more attractive to potential buyers. The following are a few tips that just might help you if you have a home on the market or if you are considering the sale of your home.

Even in the strong sellers market that we are currently experiencing in the Eugene and Springfield area, there are always a few homes that just don't sell. 9 times out of 10, the issue is price. We find that even during hot markets, overpriced homes may get looked at, but they just do not attract offers. Pricing with the market is crucial with any kind of market and today, we find that competitive pricing often brings in multiple offers and the purchase war begins. This strategy will bring about a sale for top dollar value in any market. Along with this, there are a few things that homeowners can do to make their home more attractive to potential buyers. The following are a few tips that just might help you if you have a home on the market or if you are considering the sale of your home. 1670 Ridgley Blvd

1670 Ridgley Blvd Home buyers looking for a bargain should brace themselves for some serious disappointment.

Home buyers looking for a bargain should brace themselves for some serious disappointment.

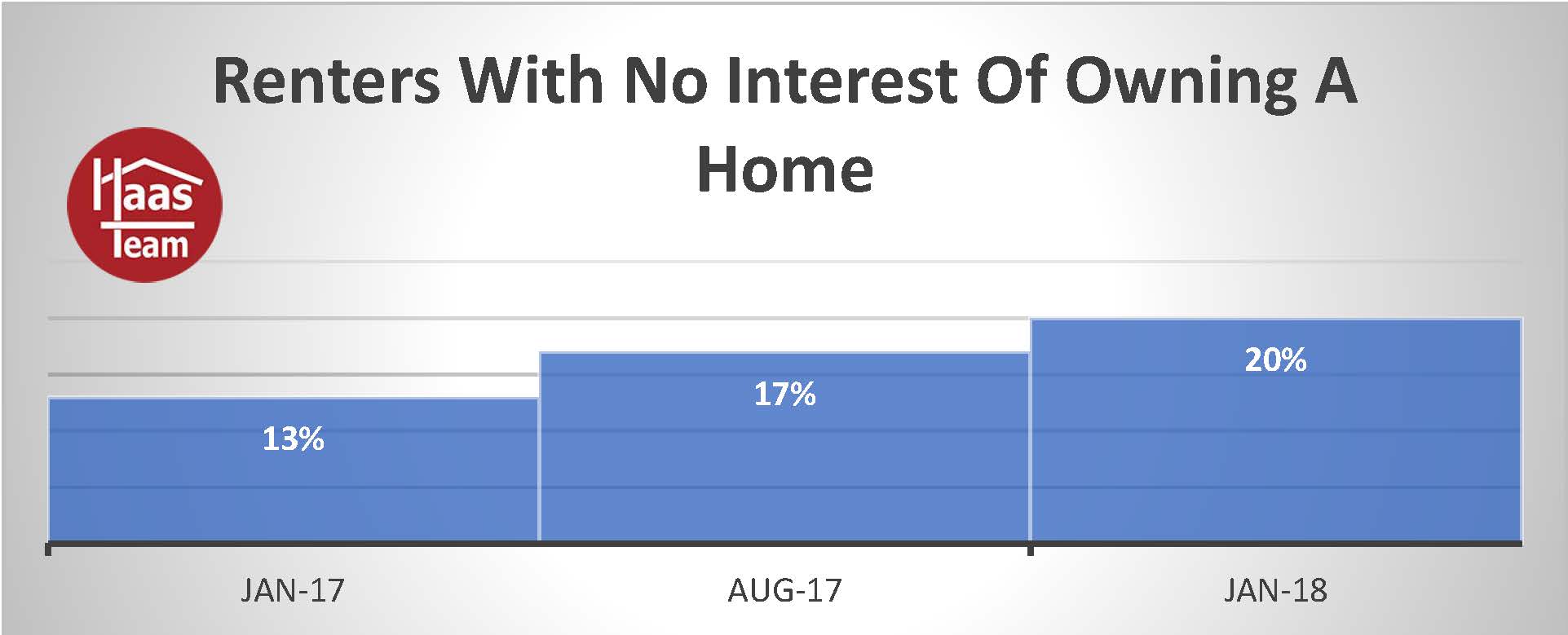

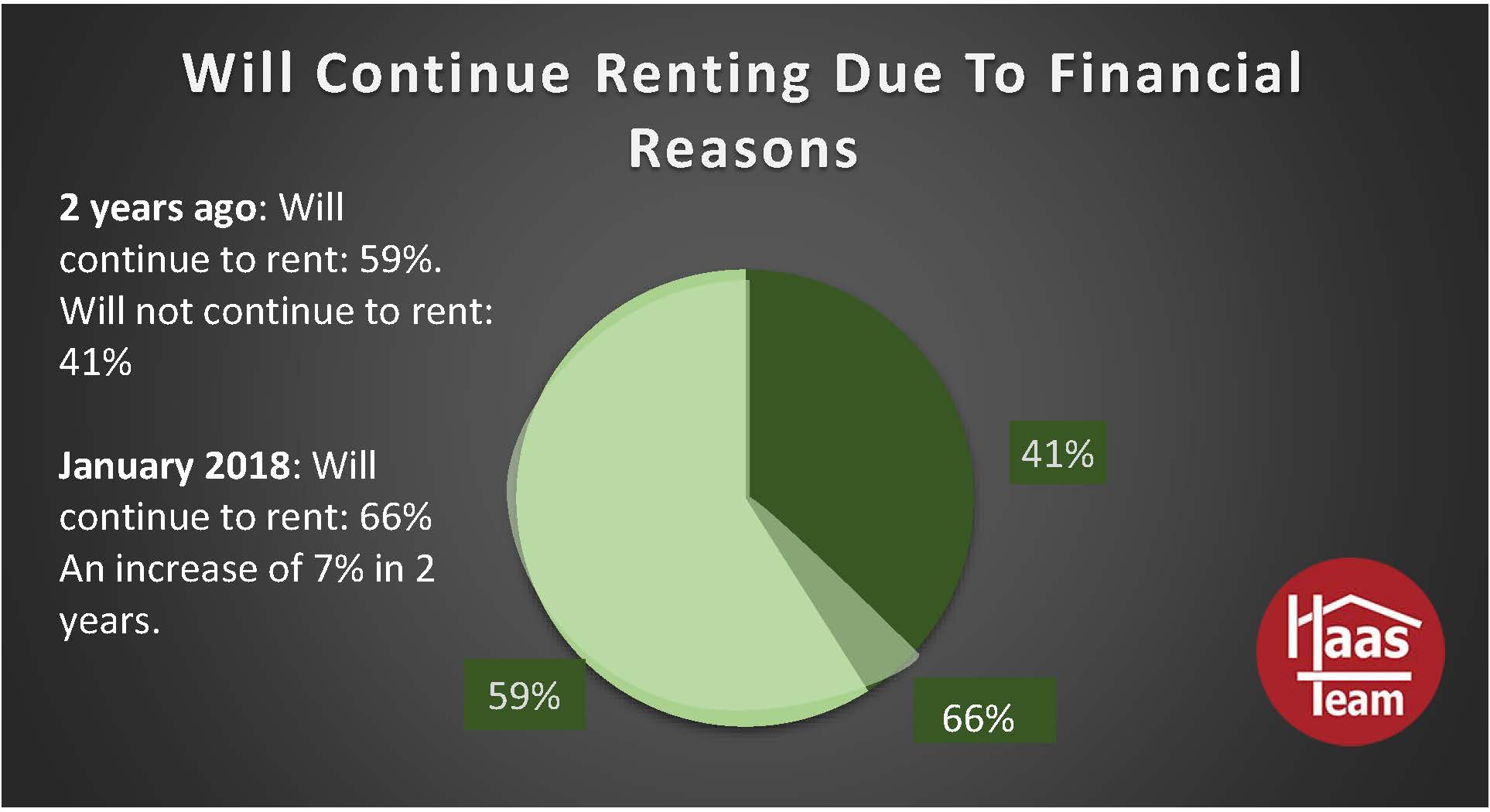

Rents have crept up in most communities just as home prices have. In fact in many areas rents have increased at a higher rate than home prices. I find today that many of the renters are paying more money to rent than they would be spending on a home payment. By renting they are also losing out on some great opportunities such as depreciation and interest tax deductions. Renters are also just making the landlords payments and not building equity. Long term the buidling of equity in a home is one of the greatest wealth building opportunities for most people. The followng is an article from "Realtor.com" on a recent study of the current trend towards renting.

Rents have crept up in most communities just as home prices have. In fact in many areas rents have increased at a higher rate than home prices. I find today that many of the renters are paying more money to rent than they would be spending on a home payment. By renting they are also losing out on some great opportunities such as depreciation and interest tax deductions. Renters are also just making the landlords payments and not building equity. Long term the buidling of equity in a home is one of the greatest wealth building opportunities for most people. The followng is an article from "Realtor.com" on a recent study of the current trend towards renting. “Housing is becoming less and less affordable. Renting is perceived to be the more affordable housing option,” said David Brickman, an executive vice president at Freddie Mac and head of its multifamily division.

“Housing is becoming less and less affordable. Renting is perceived to be the more affordable housing option,” said David Brickman, an executive vice president at Freddie Mac and head of its multifamily division. 88107 Keola Ln

88107 Keola Ln