Best Time to Buy a Home - By the Numbers

Good Morning!

Not a day passes without someone asking me if they should buy a home now or wait until the market slows down and homes are more affordable. This is an easy question to answer, because we still have affordability and we also have historic low mortgage interest rates that won't be here for ever. The following is a recent article from "Realty Times", that talks about our current market and addresses the home purchase question.

Right now, buyers have the best of both worlds -- home prices have risen, but they're still below the bubble of 2005, and mortgage interest rates are just above record lows. Yet, many buyers are still waiting for a sign that it's the right time to buy.

Should you wait for prices to go down or for lower interest rates? We advise that you do neither. The price of a home is fixed, so it makes sense to wait for prices to go lower, but you may not realize is that prices have to drop significantly to beat a minor fluctuation in mortgage interest rates.

Home prices have been rising for the past five years, sometimes in the double digits. Between January 2014 and January 2015, home prices rose over six percent. If sales continue at the current pace, it's more likely that the home you don't buy today could be more expensive later.

In the time you wait for price reductions, you could effectively build equity, or ownership in your home. Few homeowners keep a loan for 30 years anymore. People change jobs, get divorced, move up, downsize, refinance and have other reasons for not keeping their original mortgage. So the time is now.

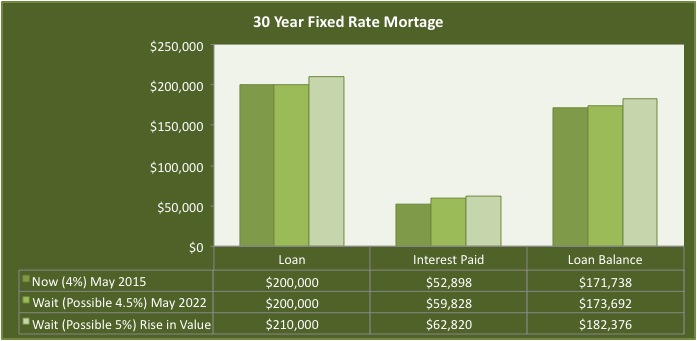

So let's look at a few what-ifs and see when it's best for you to buy a home. Using round numbers, on a $200,000 30-year, fixed-rate mortgage at 4.00 percent, your monthly payment starting May 2015 will be $955. At seven years, the average length of time that most buyers occupy their homes today, you'll pay $52,898 in interest and the remainder of your loan will be $171,738.

If you wait around and interest rates go up, you'll be paying more monthly, plus you won't build equity as quickly. At 4.5 percent, your monthly payment will be $1,013 and you'll pay $59,828 in interest. Your loan remainder is higher - $173, 692. A half a point increase in interest will cost you $58 more per month, $6,930 more in interest, and you'll end up with $1,954 less in equity.

If your home dropped 5% in value and you were able to get a loan for $190,000 and 4.5% interest, your payment would be $963, a difference of $51 less per month than if you'd paid $200,000.

But what if you're wrong and prices go up by five percent? At $210,000 and 4.5 percent interest, you'll pay $1064 per month, $62,820 in interest, and the remainder on the loan will be $182,376. That's a difference of $109 more on your monthly payment and $9830 more in interest, plus you'll lose $10,638 in equity.

Why not buy now when both prices and interest rates are lower?

Have An Awesome Week!

THIS WEEKS HOT HOME LISTING!

649 ST ANDREWS LOOP

Price: $495,000 Beds: 5 Baths: 4 ½ Baths: 1 Sq Ft: 5568

Outstanding value at $88 per sq ft - Hardwood flooring, granite counters, travertine tile, hickory cabinets, two walk-in closets, solid core 8ft doors, creek views, next to Emerald Valley Golf Resort. Too many high end amenities to list. Less than 2...

View this property >>