Good Monday Morning!

One of the largest obstacles that home buyers have dealt with for several years is the lack of inventory of homes for sale. A typical healthy home sales market for both home buyers and sellers will have from 5 to 6 months of home inventory. We have not had anything close to that kind of inventory both locally and nationally for many years. A recent bright spot in both the local and national housing markets is that the inventory of homes has started to increase. The current inventory of homes for sale in Lane County now stands at 3.1 months, and this is the highest home inventory we have seen in over a year. Part of the issue with our local inventory is the lack of new homes on the market. A decade ago, Eugene alone would see the number of building permits issued be near a thousand per year. Last year it stood at just over 100 new home building permits. This level of new home construction cripples any housing market. Even without many new homes, our local home inventory could continue to climb. We can only hope that the recent trend continues. The following is a recent article from NAR that talks about the recent increase in homes for sale on a national scale.

As the spring thaw sets in, new housing momentum is “flashing encouraging signs” for the market, says NAR Chief Economist Lawrence Yun.

A notable uptick in housing inventory nationwide may be pulling the real estate market out of a long winter hibernation.

Total existing-home sales, which account for completed transactions for single-family homes, townhomes, condos and co-ops, rose 4.2% month over month in February, the National Association of REALTORS® reported Thursday.

“Home buyers are slowly entering the market,” even as mortgage rates and home prices appear frozen at elevated levels, says NAR Chief Economist Lawrence Yun. “More inventory and choices are releasing pent-up housing demand.”

Existing-home inventory climbed 5.1% month over month in February and is up 17% from a year ago, NAR reports. Also adding to the housing supply, single-family construction rose 11.4% last month, reaching the highest pace in a year, the Commerce Department reports.

It was a frigid winter for the U.S., which helped soften foot traffic among home buyers. But as the spring thaw begins, “the momentum for home sales is flashing encouraging signs,” Yun adds.

Home Prices Remain Strong

The median price for an existing home increased 3.8% to $398,400 in February, NAR data shows. All four major regions of the U.S. recorded price gains last month, led by a 10.4% annual increase in the Northeast.

“Each one percentage point gain in home price translates into an approximately $350 billion increase in housing equity for American property owners,” Yun says. “That means a gain of nearly $1.3 trillion in home value appreciation at a time when the stock market is undergoing a correction.”

He adds that the recent uptick in inventory shouldn’t dampen home prices. “The ongoing housing shortage, coupled with historically low mortgage default rates, implies a solid foundation for home values,” Yun says.

Some home sellers may be leveraging their equity in the next home purchase. Cash sales comprised about a third of home sales in February, continuing to command a historically high share of the market. Individual investors and second-home buyers comprise a sizable portion of cash sales, purchasing 16% of homes in February, which is down from 21% a year ago, NAR reports.

Housing Affordability Headwinds Continue

With high home prices and mortgage rates in the mid-6% range, home buyers may need to dig deeper in their pockets to complete a home purchase. Despite affordability challenges, first-time home buyers comprised 31% of existing-home sales in February, up from 24% a year earlier, according to NAR. As housing inventory rises, so is the share of first-time home buyers.

Overall, buyer demand remains strong despite cost pressure. Twenty-one percent of homes sold above list price last month, according to the REALTORS® Confidence Index, which is based on NAR members’ most recent transactions. The average home on the market received 2.3 offers in February, and about 50% of agents say their listings sold in less than a month.

For buyers facing budget concerns, home builders are offering incentives to compete: Nearly 60% of builders in March used sales incentives, such as covering closing costs, design credits or mortgage-rate buydowns, the National Association of Home Builders reports. Also, 29% of builders cut their prices in March, with an average 5% price reduction.

Have An Awesome Week!

Stay Healthy! Stay Safe! Remain Positive! Trust in God!

THIS WEEKS HOT HOME LISTING!

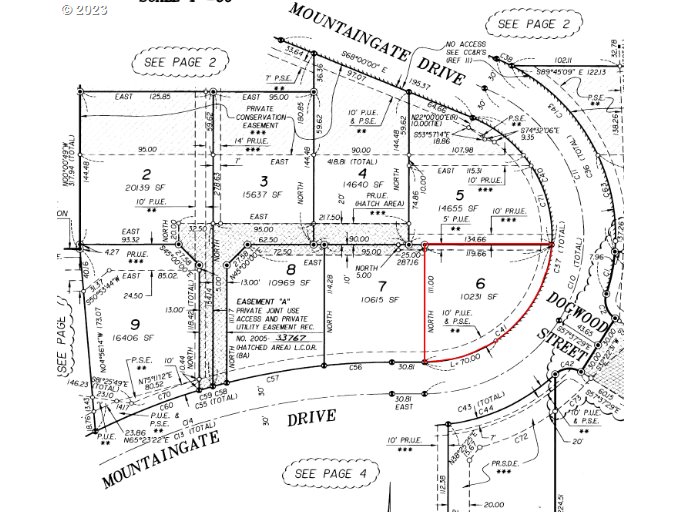

2250 Turnberry Ct, Eugene, OR

Price: $1,250,000 Beds: 5 Baths: 3.5 Sq Ft: 4053

Nestled in the highly desirable Oakway neighborhood of Eugene, Oregon, this beautifully updated single-family home offers the perfect blend of modern upgrades and timeless charm. Featuring an open floor plan with abundant natural light from expansiv... View this property >>

AND HERE'S YOUR MONDAY MORNING COFFEE!!