3 Steps To Save Money For Your Dream Home

Good Morning!

Today, with home prices rising faster than wages and a slight bump in mortgage interest rates, the home market for first-time homebuyers is tougher than it has been in a long time. Saving enough money for a downpayment and also enough money to keep monthly payments in check can be a tough task. The following article from "Realty Times" gives would be first-time homebuyers some good advice on how to prepare for a home purchase.

According to Harvard University's "State of the Nation's Housing" report, while more people than ever before want to own their own home, fewer feel financially ready to do so yet. Reasons range from high rents to student loan debt. Millennials, in particular, are waiting longer to get married, start families and purchase their first home. But this is not necessarily bad news for the housing market. In fact, it could mean that the millennial generation has something to teach us all about saving consistently towards a big life goal such as owning your own home!

In this article, learn three important steps to take when you start saving for your dream home.

Step 1: Pay down your debt to clean up your credit.

Your credit score is a tricky business when it comes to saving for your first home. You have no history of carrying a mortgage, so you can't make any real impact there. What you can do is to clean up your overall credit report so your general credit score is as healthy as possible before you apply for your mortgage loan.

According to the National Foundation for Credit Counseling (NFCC), a surprising number of Americans think they have "above average" (60 percent) to "very good" (41 percent) credit, although a full 48 percent have not seen their credit score in the past three years or ever.

So clearly, this is where you need to start. The best way to differentiate yourself from your competition (other people who are trying to convince a direct lender to give them a mortgage loan) is to pay down your debt, clear up any disputes on your credit report and, in so doing, boost your credit score so you can qualify for the best mortgage at the lowest interest rates.

Step 2: Separate and automate your savings.

Saving money is never going to be the easiest goal you attempt. In fact, according to The Atlantic, one of the chief reasons that nearly half of all Americans have little or no emergency savings to fall back on is taking on too much mortgage debt.

So here is a clear area where you should proceed with caution. First, save. Then, buy a home. The best approach to make saving as painless as possible for you is to automate your savings. You can do this by setting up direct deposit on your paycheck and then regular auto-drafts into a savings account reserved just for dream home savings. This way, you never even touch those funds and feel tempted to spend them instead.

Step 3: Downsize to upsize

Finally, one effective change many adults today are making to save more towards their dream home is to downsize while they save. This can mean anything from moving to a smaller apartment to getting rid of your cable television subscription. Also, you must continually remind yourself why you have downsized in order for this step to work well.

But the key to making downsizing work to serve your greater goals is to make sure you deposit every cent of what you save into your dream home fund. Referring back to Step 2 here, the easiest way to do this is to calculate for yourself exactly what you are saving by paying less rent, giving up cable, etc., and then setting up a monthly auto-draft in that amount to deposit directly into your dream home savings account.

By following these three steps, you can make tangible financial progress in saving to buy your dream home. If you can save 20 percent towards a downpayment, you can avoid paying expensive Private Mortgage Insurance (PMI) and you may even qualify for a lower interest rate. Scrimping and saving is never fun or easy, but it will be worth it when your realtor hands you that brand-new set of house keys!

Have An Awesome Week!

THIS WEEKS HOT LISTING!

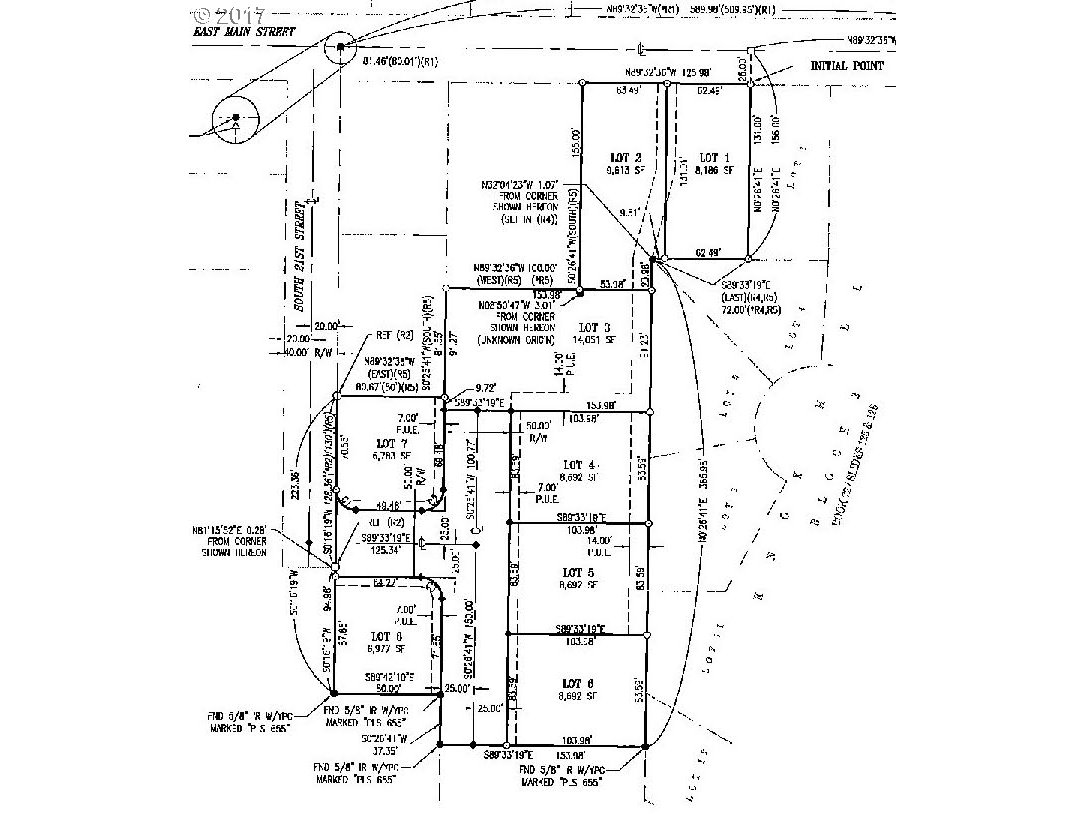

Price: $225,000 Beds: 0 Baths: 0 Sq Ft: 0

Development property platted for 8 residential building lots. Easy access for roads and utilities. Lot sizes range from 6,700 sq. ft. to 14,000 sq. ft. Plat map and estimate on development costs available upon request....View this property >>